Volume of professional job vacancies reduce in April, but demand for AI & Data professionals continues to be resilient

20 May 2025.

Global white-collar vacancies fall -11.6% in April 2025 compared to March 2025

Hiring for AI and data roles remains resilient – Machine learning vacancies grow +27% in April, with demand shifting toward infrastructure and engineering skills

USA sees -16.2% drop in April 2025 vacancies vs March 2025 following the implementation of trade tariffs

UK sees a -12% drop in vacancies as national insurance increases and changes to employment rights come into action

Professional Services emerges as strongest performing sector globally in April – up +9.9% month-on-month, with standout growth in India (+36%)

Financial Services sees mixed performance – global vacancies fall -8.5% month-on-month, but France posts +5% increase

Global professional job vacancies saw a -11.6% month-on-month decrease in April compared to March, continuing a period of fluctuating hiring activity across the globe.

Toby Fowlston, CEO at Robert Walters comments, “While individual months have swung between sharp rises and falls, the broader trend suggests a recruitment market in flux rather than in decline. The statistics point to a cautious hiring environment with pockets of strategic activity, where employers are adjusting to economic unpredictability and external pressures rather than pausing recruitment outright.”

The findings come from Robert Walters Global Jobs Index, published today on Tuesday 20 May in partnership with Vacancysoft. It is the only index of its kind to track job flow for professional roles across the globe by looking at external job adverts posted online in real time.

AI & Data Talent: Demand Shifts Toward Infrastructure

Hiring for AI and data roles held steady in April, with machine learning postings up +27% month-on-month. Much of the current demand is centred on data engineers – the specialists responsible for building the infrastructure needed to scale AI in real-world settings.

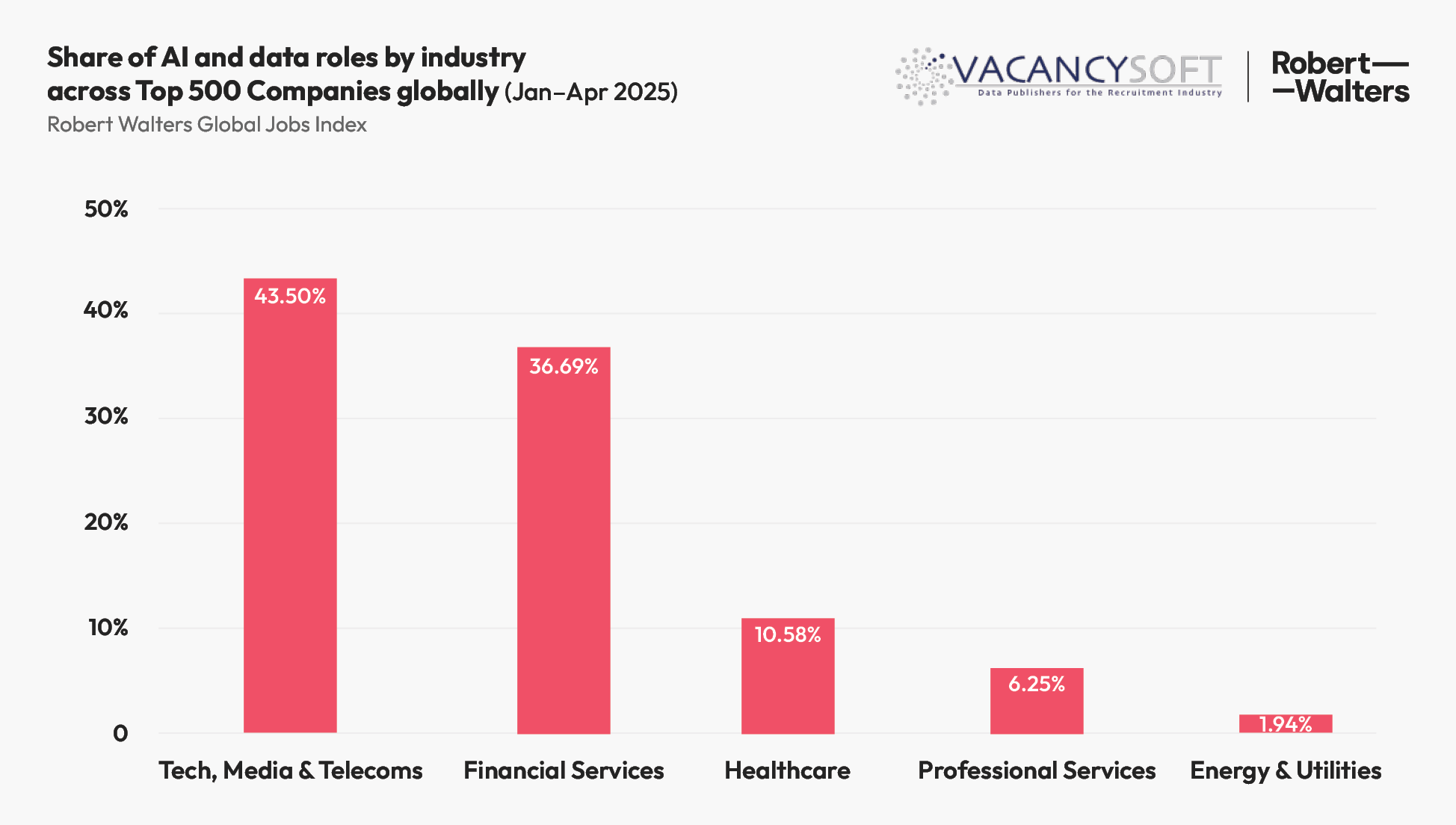

Technology, Media & Telecoms companies accounted for the largest share of AI and data roles so far in 2025 (43.5%), followed by Financial Services (37.0%).

“As AI moves from pilot projects to enterprise-wide deployment, we’re seeing greater demand for talent that can build and maintain the underlying data infrastructure. That’s especially true for data engineers and technical specialists,” adds Toby. “It’s a fast-evolving space – and businesses are increasingly looking for people who can help them scale responsibly and effectively.”

Mixed Picture Across Global Markets

In April, France saw a +3.5% month-on-month increase in professional vacancies – a notable uptick in an otherwise subdued European market. Much of this growth is attributed to growing demand in Healthcare (+13.0%), Technology, Media & Telecommunications (+12.0%) and Financial Services (+5%). Notably, the United States recorded one of the sharper declines in April, with vacancies down -16.2%, while the UK also fell by -12.0%.

“In the US, changes to tariff policies have led to uncertainty for companies exposed to international trade, prompting a more cautious approach to headcount planning. While in the UK, recent changes to National Insurance are making some employers reassess short-term cost structures,” adds Toby. “This environment is prompting companies to be more selective, with a with a greater emphasis on roles that can drive productivity, short term revenue or cost savings."

Sector Snapshot

Professional Services

Professional Services was a notable outlier in April (+9.9%), with strong growth in India (+36%) and Italy (+6.6%) driven by increased demand for consultants and advisory expertise.

“Consulting and legal services are often early indicators of shifting business priorities,” says Toby. “These sectors tend to grow when companies are preparing for change – whether that’s digital transformation, new regulations, or cross-border expansion.”

Technology, Media & Telecoms (TMT)

TMT remained the largest hiring sector globally, representing 35% of all vacancies. However, the industry posted a -17.9% decline in April as companies moderated hiring after a strong March.

France defied the trend, with TMT vacancies rising +12.0%. By contrast, the US (-25.0%) and UK (-18.0%) saw a significant decline.

Toby says, “The increase we’re seeing in France follows a slower start to the year, when many organisations paused external recruitment amid economic uncertainty and focused on internal mobility."

As conditions begin to stabilise, tech firms in particular are increasing hiring activity to support their digital growth and transformation.

Financial Services

Hiring in Financial Services fell -8.5% globally in April. However, France saw modest growth (+5.0%), while Poland recorded only a slight downturn of -2.7%.

“Hiring currently is less about headcount growth and more about reinforcing core operations,” explains Toby. “We’re still seeing a demand for roles in governance, risk, and controls – key areas that help financial institutions stay ahead of regulatory requirements and navigate operational uncertainty.”

For Media Enquiries

Carmen Walker

PR Manager

E: Carmen.walker@robertwalters.com

T: 020 7509 8481

Related content

View AllMarch Sees Global Uptick in Professional Job Growth, but future impact of US trade tariffs remains to be seen Global white-collar vacancies jump +31% in March 2025 compared to February 2025 across all industries following a month-on-month decline in February USA sees +38% rise in vacancies in March

Read MoreUSA (+4.43%), UK (+7.27%), and Poland (+3.34%) were the only countries in Top 10 to post more white-collar vacancies in February vs January 2025 -8.29% decline in professional roles globally in February 2025 (vs Jan ’25) Industrials (+9.83%), Energy & Utilities (+6.90%), and Consumer Goods & Service

Read MoreFinancial services vacancies increase globally by +11% in 2024 (vs previous year) Technology, media and telecoms (TMT) globally saw an uplift in vacancies of +25% in 2024 (vs previous year). Professional services has had the smallest quarterly drop across the major industries (Q4 vs Q3) - and in ter

Read More